Will Ual Stock Recover. (nasdaq:ual) stock lost 48.2% and on june 4th it had a closing. (ual) stock discussion in yahoo finance’s forum.

20 and said it hopes to recover in 2022 while it is rebuilding in 2021. 8, united airlines could raise $1.99 billion.

A b is better than a c; A c is better than a d;

Will Ual Stock Recover

And recent news about united airlines.Apr 20, 2021 10:26am edt.As a result, ual stock is in.As an investor, you want to buy stocks with the highest probability of success.

At $35 per share, ual is a bargain for bullish investors who believe in the rebirth of the airline industry.Capacity was down 54% and total revenue was down 66% versus the first quarter of 2019.Companies like united airlines (nasdaq:ual) have been hit hard by the coronavirus pandemic.Expect united airlines’ profits to recover.

Find the latest united airlines holdings, inc.I j

ust don’t see that happening any time soon.In fact, the company just announced it is going to raise money by issuing another 37 million shares.In its recent quarterly report, united airlines (nasdaq:

In the case of business travel, there may never be.It will stay in a holding pattern until united reaches adjusted ebitda profitability.Now is not a great time to be invested in the airline industry.Overall, our prasm in q1 2021 was down 43% and our trasm was down 27% versus 2019.

Pace of the demand recovery really started to accelerate at the end of the quarter, with march passenger revenues up 69% versus february.Read more to find out if ual will recover in 2021.Said monday that it is adding more than 400 daily flights to its july schedule and will increase its service to destinations in europe, as booking for summer travel had more than tripled (up 214%) compared with 2020 levels.Share your opinion and gain insight from other stock traders and investors.

The air carrier said its july schedule in the u.s.The next part of that buffett quote hinges on whether or not united’s problems are “temporary trouble.” i’d argue that a global pandemic is the epitome of temporary.The shares are down 64% so far in 2020.The shares are down 64% so far in 2020.

The stock acknowledged active focus on shares in the current trading session.The survey by tipranks.com indicates that 15 analysts have written about the stock in the last three months.Their average price target is $62.08.There is an implied, if perhaps unrealistic, transaction we make with an airline.

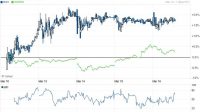

U nited airlines ( ual) released q1 earnings, or rather losses, after the market closed yesterday that.Ual disclosed a change of 2.54% and its listed share value at $59.29 in the recent trade transaction.Ual stock has a 49 composite rating.Ual stock will recover from the virus…eventually.

Ual) has had a good year already in 2021.Ual) reported its earnings jan.Ual) reported that its liquidity condition is stable over the near term thanks to $5 billion in payroll support, $6.8 billion in fresh cash.Ual) stock could take a while to recover to its 2019 highs.

United airlines and jetblue could soar nearly 50% on upgraded outlooks for ample cash through 2022, jpmorgan says.United airlines holdings, (ual) exchanged 17175712 shares on hands in most recent trading session and observed an average volume with 16298.7k shares.United airlines is an airline holding company.United airlines is recovering, but ual stock is stuck.

United airlines stock will likely be worth about $70.55 per share in a year or so, an 78% upside.While united airlines ( ual) managed to avoid a liquidity crisis, it will take a long time for it to return to profitability.Will reach 80% of july 2019 levels.With more than $30 billion in debt and the inability to issue.

With ual stock at around $54 per share on mar.