Is Zoom Technologies A Good Stock To Buy. (nasdaq:zm) is not the most popular stock in this group but hedge fund interest is still above average. (nasdaq:zm), with a stake worth $1005.6 million reported.

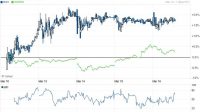

25, 2021 at 12:00 p.m. After reporting earnings on december 5, the stock — which soared 45% to peak at $105 on july 31 — lost nearly 10% of its value between.

37 Zoom Background Ideas To Make Your Guests LOL

As you can see, there were an average of 41.7 hedge funds with bullish positions in these stocks, with an average investment of $2632 million. At current levels, zoom is trading like a cult stock.

Is Zoom Technologies A Good Stock To Buy

In 2019 its revenue was 622 million usd.In the 2020 fiscal year, those profits jumped more than threefold, from $7.6 million to $25.4 million as.In the case of zoom stock, the amount was $6002 million.Is it a buy right now?

Is zm a good stock to buy?Is zoom a good stockto buy?It is worth mentioning that zoom’s success has been of an immense amount in comparison to slack technologies.It went public on april 18, 2019, with a starting share price of us$36 per share;

Many people prefer zoom stock to slack technologies.Marketbeat just released five new stock ideas, but zoom technologies wasn’t one of them.Marketbeat just released five new stock ideas, but.Marketbeat thinks these five companies may.

More specifically, hillhouse capital management was the largest shareholder of zoom video communications, inc.Revenues top estimates, up y/yShares of $zoom are up 50% today because video conferencing is expected to benefit from the coronavirus.Subsequently, the sec stepped in and removed zoom from the stock market.

Suzanne frey, an executive at alphabet, is a member of the motley fool’s board of directors.The company is also creating a monetizable marketplace that will help accelerate its growth.The company’s ipo was in april 2019 at $36 a share.The share price increased over 72.1% on the very first day of its trading.

The ticker zoom belongs to a chinese company that makes parts for mobile devices.Therefore, while zm is not a cheap stock, i believe it makes a good investment at the current price.Thus, at a share price above $200, prudent investors should avoid zoom stock.Volume fell on the last day along with the stock, which is actually a good sign as volume should.

Wall street analysts have given zoom technologies a n/a rating, but there may be better buying opportunities in the stock market.Wall street analysts have given zoom technologies a n/a rating, but there may be better buying opportunities in the stock market.What makes zoom video communications (zm) a strong momentum stock:What makes zoom video communications (zm) a strong momentum stock:

While the demand for the company’s services is not expected to decline anytime soon—because the remote working and learning trends adopted during the pandemic may continue indefinitely—growing competition might.Your current $100 investment may be up to $1548.63 in 2026.Zm stock owns an ibd relative strength rating of only 39 out of a possible 99.Zoom (the video chat platform) trades under the ticker zm.

Zoom is $zm.$zoom has been out of business for years.Zoom stock has fallen 13% since going public in april.Zoom stock is a hold for me now, but it could be a good buy in the medium to long term if there is a further correction in zm’s share price implying more attractive valuations, and the company.Zoom stock is now traded on nasdaq with the ticker symbol zm.

Zoom stock success in the market.Zoom technologies inc has a bullish sentiment reading.Zoom technologies inc stock has risen 36.07% over the past week and gets a bullish rating from investorsobserver’s sentiment indicator.Zoom’s stock symbol is zm.