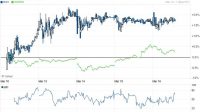

Am Stock Dividend Safe. +0.33 (+3.31%) closed at 4:00 pm et on jun 21, 2021. 100.00% (trailing 12 months of earnings) 120.00% (based on this year’s estimates) 105.88% (based on next year’s estimates) 66.96% (based on cash flow) am dividend frequency:

A 28% decline since feb. A return to higher dividend growth is possible.

3 Stocks To Watch While The Market Dips In 2020 Stock

A safe dividend stock is a company that can safely cover the dividend regardless of the economic environment we are in. A stock’s dividend reliability is determined by a healthy payout ratio that is higher than other stocks.

Am Stock Dividend Safe

Am’s went public 4.12 years ago, making it older than only 14.22% of listed us stocks we’re tracking.And then, simply safe dividends, we are so grateful to find we can safely repose that trust in you.Antero midstream corporation common stock (am) nasdaq listed.Based on the closing price of $8.65 per share on apr 14, the stock has a dividend yield of 10.4%.

But its quarterly dole appears safe for now.But recent dividend increases have not been as attractive.Data is currently not available.Dividend investors, by nature, look for stable companies to add to their portfolios.

Dividing the annual dividend/distribution by the existing stock/unit price gives you the dividend yield.Even before the issues facing oil companies were magnified by the opec supply shock, pembina was considered a.For am, its debt to operating expenses ratio is greater than that reported by 95.51% of us equities we’re observing.For years past we have searched and searched, while making as educated choices as we could given what was available to maintain dividend income.

Here is what a safe dividend growth looks like from td bank.Investing guidance has been a challenge, in which trust is not wisely handed out willy, nilly.It has not yet cut its dividend, implying that it may as yet be safe.Its new annualized dividend amounted to 90 cents per share.

It’s not gold, it’s not stocks, it’s not bonds, it’s not homes… find out what it is here.It’s not gold, it’s not stocks, it’s not bonds, it’s not homes… find out what it is here.Look to see how quickly the dividend.Morningstar has a “buy” rating and $82 fair value estimate for dfs stock.

Our deep gratitude to you, for your pragmatic, focused efforts and advices.Pacw), which offers a dividend yield of over 5% at the moment.Safe stocks for dividend investors by george l smyth.Shares offer a dividend yield of 4.5% at the moment, which is 3.5x the average yield of the s&p 500 index.

The annual dividend for 2019 as we saw above was 14.89.The formula for free cash flow payout ratio is simply annual dividend per share divided by free cash flow per share.The free cash flow also from morning star is 29.23.The other banking dividend stock to consider today is pacwest bancorp (nasdaq:

The ssd score is simply safe dividends’ dividend safety score.There are numerous metrics that one can examine when considering a stock purchase.Three numbers are especially helpful to the dividend investor.Using the annualized dividend of $2.65 and our expectation for $4.58 of earnings per.

While they wait for the recovery, investors can enjoy the stock’s relatively safe 5.3% dividend.