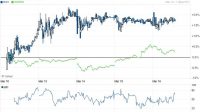

Nike Stock Price History Split. $133.35 +0.25 (0.19%) jun 23, 7:58 pm. +2.40 (+1.85%) data as of jun 22, 2021.

34 wall street analysts have issued ratings and price targets for nike in the last 12 months. 43 rows historical daily share price chart and data for nike since 1980 adjusted for splits.

Eliud Kipchoge First Person In Recorded History To

According to ceo mark parker, “in a growing sports industry, nike. After the nike stock split, there will be 353 million class a shares and 1.36 billion class b shares on the market.

Nike Stock Price History Split

By comparing the price change ratio to the stock split ratio, we can check if nike inc (nke) had favorable outcomes during stock split(s).Calculate (enter number of shares) dec 26, 2012:Common stock (nke) nasdaq listed.Data is currently not available.

Discounted offers are only available to new members.Discover historical prices for nke stock on yahoo finance.Even in an intensely crowded market, nike’s approach in paris stands out.Investors obviously liked this, and nike’s stock rose 3.7 percent to $130.45 with a market capitalization of $107.2 billion.

Its last stock split was in april 2007.Its outperformance over the s&p 500 reached its highest point in the final week of the year, with.Its widely traded class b shares gained 23 cents to close at $90.83 thursday.Johnson and johnson stock split history.

Jpmorgan chase and stock split history.Nike ( nyse:nke) stock is ending 2020 with a bang.Nike (nke) has 6 splits in our nike stock split history database.Nike (nke) has 6 splits in our nike stock split history database.

Nike (nke) has 6 splits in our nke split history database.Nike inc has risen higher in 32 of those 40 years over the subsequent 52 week period, corresponding to a historical accuracy of 80 % is nike inc stock undervalued?Nike stock price history data the price series of nike for the period between tue, mar 9, 2021 and mon, jun 7, 2021 has a statistical range of 17.83 with a coefficient of variation of 2.64.Nike’s share price has soared over the past few years despite the recession.

Nike, inc., based near beaverton, oregon, is the world’s leading designer, marketer and distributor of authentic athletic footwear, apparel, equipment and accessories for a wide variety of sports and fitness activities.On average, they anticipate nike’s stock price to reach $161.47 in the next year.Over the next 52 weeks, nike inc has on average historically risen by 22 % based on the past 40 years of stock performance.Price (close) price the day before:

Psg has been one of nike’s most visible soccer properties since the 1990s and most recently renewed its agreement in 2019, one year after the allegations against neymar first surfaced internally at nike.Quarterly dividends on nike common stock, when declared by the board of directors, are paid on a calendar year basis on or about january 5, april 5, july 5 and october 5.Stock advisor launched in february of 2002.Stock advisor list price is $199 per year.

The company also declared a 17 per cent hike in its quarterly dividend to 21 cents per share.The current contract runs until 2032.The current nike inc share price is $133.60.The daily prices for the period are spread out with arithmetic mean of 134.76.

The first split for nke took place on october 08, 1990.The first split for nke took place on october 08, 1990.The first split for nke took place on october 08, 1990.The high price target for nke is $192.00 and the low price target for nke is $115.00.

The median price for the last 90 days is 134.06.The score for nke is 65, which is 30% above its historic median score of.Their forecasts range from $115.00 to $192.00.This marks the seventh time in nike’s history it has split shares.

This section helps you learn the impact on share prices before and after the split.This suggests a possible upside of 20.9% from the stock’s current price.View daily, weekly or monthly format back to when nike, inc.We examined the performance of nike stock compared to the s&p 500 index (benchmark for us large cap stock market) both 1 week and 1 year after the announcement of the last four stock splits in 1996, 2007, 2012 and 2015.

We will check the price/share 7 days (market open days) before and after the stock split.What is a favorable scenario?