High Iv Stocks Reddit. 2 best reddit healthcare stocks to buy now. 3 meme stocks wall street predicts will plunge more than 20%.

7 reddit stocks in trouble if the tech stock selloff continues. Aht, btx, geo, pubm, sklz, wish.

A Good Glass Of Beer Edouard Konst

All stocks in the market have unique personalities in terms of implied volatility (their option prices). And price is between $10 and $100.

High Iv Stocks Reddit

Buyers of stock options before earnings release is the most common.Can reddit take canoo stock to the moon next after amc entertainment and gamestop?Cciv) has risen by 11.63% on monday, closing at $24.95 after already hitting a high of $27.30.Chur

chill capital corp iv (nyse:

Current implied volatility >= 100%.Current implied volatility >= 100%.Eps growth greater than 5% (continuing to grow operations), altman z score greater than 2.75 (low risk of insolvency and bankruptcy).Even more, the 30% iv stock might usually trade with 20% iv, in which case 30% is high.

For example, one stock might have an implied volatility of 30%, while another has an implied volatility of 50%.He pointed to global x superdividend etf.Here are 50 of the highest dividend paying stocks with strong fundamentals.Here is a list of high iv stocks (data from june 11th) using this criteria:

Hi all, here is a list of high iv stocks (data from june 4th):If a company has cut their dividend in the last 12 months.If i were to tell you that a stock’s implied volatility is 50%, you might think that is high, until i told you it was a.Implied volatility is a theoretical value that measures the expected volatility of the underlying stock over the period of the option.

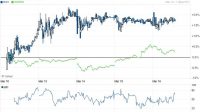

Iv crush is the phenomenon whereby the extrinsic value of an options contract makes a sharp decline following the occurrence of significant corporate events such as earnings.Iv rank of 10 make this a poor.Iv rank or implied volatility rank is a metric used to identify a security’s implied volatility compared to its iv history and is an important metric for day traders.Looking at the iv rank and percentile helps you determine whether the symbol’s option prices (iv) are relatively high or low, and can assist you in determining an appropriate options strategy.

Market capitalisation >= $1 billion.Market capitalisation >= $1 billion.Out of 373 stocks in the biotech industry, it is ranked #58.Please note that the listed annual payout and dividend yield is based on the previous 12 months of dividend payments.

Please suggest if you would still avoid tsla.Reng has been accorded a grade of “b” for peer grade in our powr ratings system.Show stocks where the average day range (50) is above 5%.The fun ride might not last if analysts are right about these stocks.

The highest implied volatility options page shows equity options that have the highest implied volatility.The list is sorted by dividend yield from high to low, and our analysis is updated daily.The subreddit r/wallstreetbeats, which helped to spike the stock for gamestop and amc earlier this year, took an interest in wwe stock.These seven reddit stocks could see major declines if tech stocks drop lower.

This high valuation, for a company that has generated just $3.5 billion in sales in the past 12 months, may.To search for stocks that routinely display high volatility and heavy trading volumes, go to stockfetcher or another screener of your choice.Trevena thinks it can help hospitals achieve 10 times in medical savings by switching from iv.Unfortunately, this implied volatility crush catches many options trading beginners off guard.

Vaccines and zero rates to broaden recovery.We answer some frequently asked questions about the wheel strategy in our theta gang faq.We update this list daily.Wwe stock received a big boost on wednesday, june 9 thanks to the popular subreddit r/wallstreetbeats.

Yet, after being one of the top performing of the reddit stocks, shares have taken a big dive, from nearly $3 per share, to $1.45 per at the moment.You may also choose to see the lowest implied volatility options by selecting the appropriate tab on the page.You suggested sell high (buy low) when the iv rank is high.