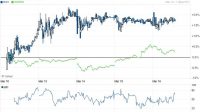

Evgo Charging Stations Stock Price. 800+ convenient and reliable fast charging stations, 67 metropolitan areas, 2 easy plans, the open road. According to evgo’s investor presentation, its pro forma valuation ev was $2,056 million.

As of december 31, 2020, it deployed approximately 16,617 ev charging stations. Based on the current market price of $11.04.

168 GM Ditching Bechtel For EVgo Chinese Market Facing

But cheapness isn’t always the best reason to buy a stock, and all four companies have potential. Chargepoint had 731 locations as of june, electrify america had 438 and blink was part of a.

Evgo Charging Stations Stock Price

Evgo doesn’t forecast being free cash flow positive until 2026 and revenues won’t top $500 million until hitting a forecasted $596 million in 2025.Evgo expects to raise around $575 million from the deal.Evgo is a leading owner and operator of fast charging stations in the u.s.Evgo is an electric vehicle (ev) charging company that offers services throughout the u.s.

Evgo is the leader in dc fast chargers (dcfcs) in the.Evgo is the leader in dcfc trailing only tesla by the number of locations with fast charging stations.Evgo to go public via spac in bid to power ev charging expansion.Evgo’s $7.99 monthly membership plan includes the first 25 to 34 minutes of your charging activity every month, depending on your charger locations.

Evgo, chargepoint spac stocks fall.Evgo, which plans to go public in the second quarter through a $2.6 billion spac deal, owns and operates more than 800 charging locations in 67 major markets across 34 states.Find the latest ev charging usa inc (evus) stock quote, history, news and other vital information to help you with your stock trading and investing.Gm) selected evgo for a nationwide ev charging infrastructure.

Here’s a breakdown of some of evgo’s partners and what the relationship holds for the future.It will also see shares of clii stock change to the new evgo stock ticker.Meanwhile, at clii’s current stock price, evgo is valued at around $2.83 billion.More than 130 million people in the us live within a 10 mile drive of an evgo fast charger.

No date has been set for when the stock will be publicly available, though sources say the deal is expected to close in june 2021.Other ev charging players, however, each have unique leadership positions.Planning 500,000 charging points for evs by 2025, shell becomes the latest company swept up in ev charging boom.Tags greenlots norway super bowl.

The company expects to add 2,700 stations to its network.The company offers its services through field sales force and resellers, as well as sells residential level 2 chargers through various internet channels.The deal is expected to bring in $575 million for evgo.The first thing to note is evgo has strong partnerships.

The oil giant will report q4 results on feb.The resulting valuation of the newly combined company is expected to be $2.6 billion, based on the spac’s initial price.The shares will be available on the nyse under the ticker symbol evgo.The total market value of the ev charging stocks.

There’s no news yet about how much the stock will cost when it goes public.This time, it’s evgo, one of the leading providers of electric vehicle charging stations in the us.This was based on a share price of $10.Was founded in 2009 and is headquartered in miami beach, florida.